Income contingent repayment calculator

IBR has been around since 2007 when President George W. Use our Income-Contingent Repayment Calculator ICR to estimate the monthly loan payments and total payments for each of the income-driven.

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

The Income-Contingent Repayment ICR plan is available only for Direct Loans.

. Still if you have a parent PLUS loan i. In order to qualify you must have more than 30000 in outstanding Direct Loans or FFEL Program Loans. The remaining balance monthly payment and interest rate can be found on the monthly student loan bill.

Student Loan Hero is wholly-owned by LendingTree a Marketing Lead Generator and Duly Licensed Mortgage Broker with its main office located at 1415 Vantage Park Dr. However your FFEL Program Loans would not be eligible. To remain on the ICR plan you must recertify annually by submitting the application and supporting documentation.

The calculator also assumes that the loan will be repaid in equal monthly installments through standard loan amortization ie standard or extended loan repayment. The results will not be accurate for some of the alternate repayment plans such as graduated repayment and income contingent repayment. If you have 32000 in outstanding Direct Loans and 12000 in outstanding FFEL Program Loans you may be able to choose this plan for your Direct Loans.

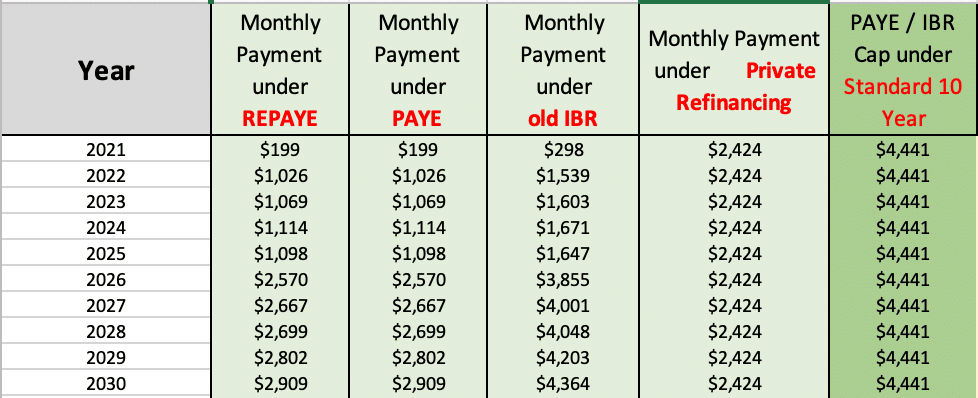

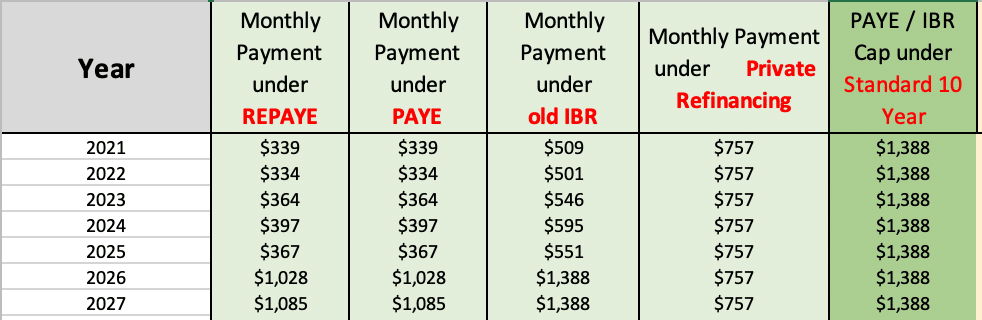

Income-contingent repayment bases the monthly payment on 20 of discretionary income which is defined as the amount by which income exceeds 100 of the poverty line with a 25-year repayment term. The lesser of 20 of discretionary income or the amount. But its actually a specific federal program for certain types of borrowers.

Income-contingent repayment ICR is the oldest of the income-driven repayment plans and it also may be the most expensive. It will be whichever amount is lower. 3 Lower your total loan costget a 025 percentage point interest rate reduction when you enroll in and make monthly payments by auto debit.

If youre having difficulty making payments on the standard 10-year federal repayment plan an income-contingent repayment will reduce your monthly PLUS loan payment to 20 of your income or the. Payments could be 0. The monthly loan payment under an income-driven repayment plan is zero if the borrowers adjusted gross income is less than 150 of the poverty line IBR PAYE and REPAYE or 100 of the poverty line ICR.

The monthly payment amount for an Income-Contingent Repayment ICR plan is calculated differently than for any other kind of IDR. IBR stands for Income-Based Repayment Sometimes people talk about IBR casually to mean all types of income-driven repayment plans. 7 Pay no origination fee or penalty for paying off your Law School Loan before its due date.

Use the calculator below to evaluate the student loan payoff options as well as the interest to be saved. 20 of your discretionary income or What you would pay on a repayment plan with a fixed payment over the course of 12 years adjusted according to your income 8. Bush signed a big overhaul of federal financial aid practices.

Federal Student Aid. If your monthly payment is zero that payment of zero still. For example if you start out making 25000 and have the average student loan debt for the class of 2020 38792 you would be making monthly payments of 424 under the Standard Repayment Plan.

The difference between the Standard Repayment Plan and the Income-Based Repayment plan is substantial. Save time with a streamlined application and get the money you need year after year with our Multi-Year Advantage. Charlotte 28203 Telephone Number 866-501-2397 TDDTTY.

Income-Contingent Repayment Plan ICR - This plan is also based on your discretionary income recalculated each year and can take your spouses income into consideration if you file your taxes jointly. Low-income borrowers may qualify for a student loan payment of zero. Federal Student Aid.

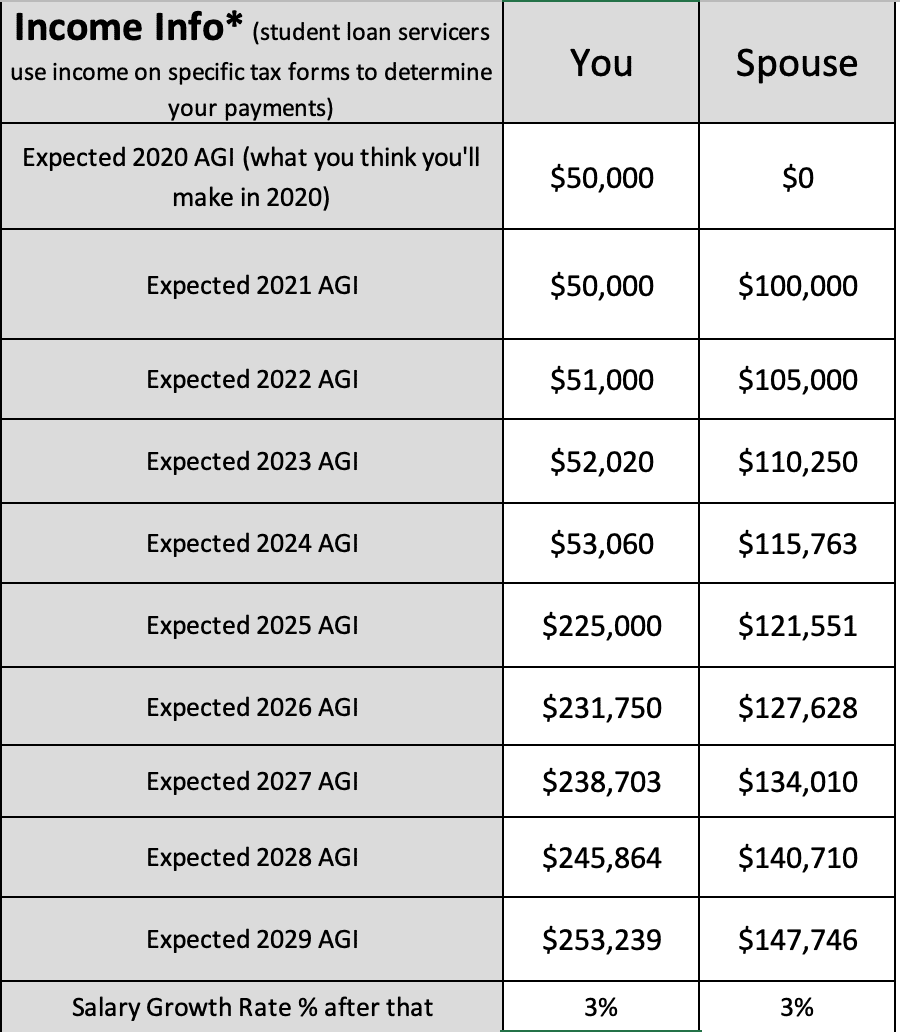

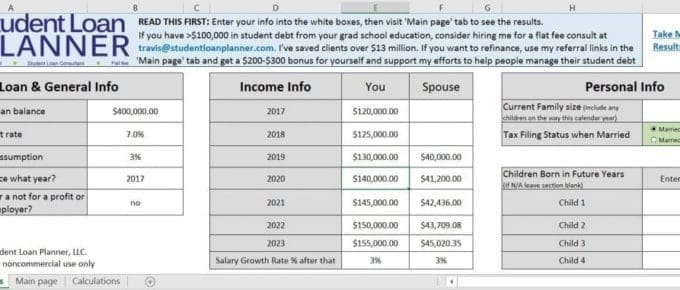

Each year your monthly payment is calculated based on your adjusted gross income family size and total Direct Loan debt. However the payments in this plan are the lesser of either 20 off your discretionary income or fixed amount over 12 years adjusted based on. Student Loan Repayment Calculator.

Educational Loan Minimum Monthly Payments.

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

What Is Standard Repayment

Defining And Calculating Discretionary Income For Student Loans

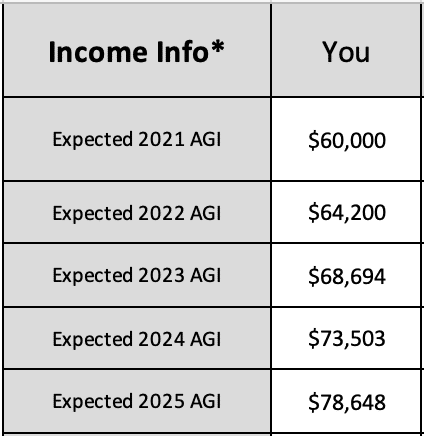

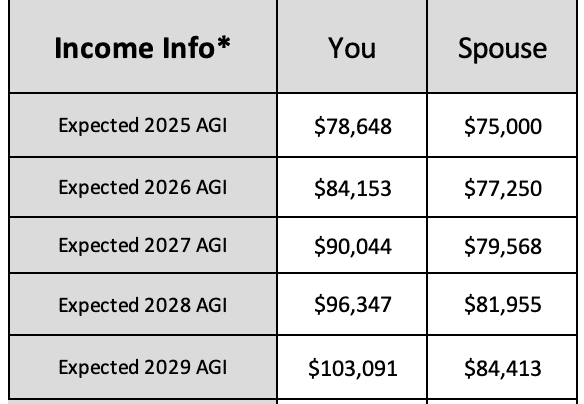

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Income Driven Repayment Calculator Fitbux Articles

Student Loan Forgiveness Calculator With New Biden Idr Plan 2022

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

Pros And Cons Of Income Driven Repayment Plans For Student Loans

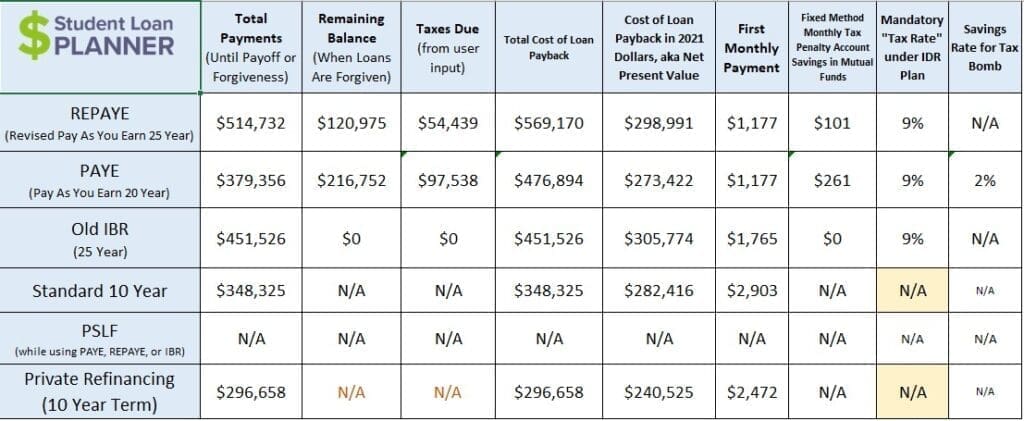

Paye Vs Repaye Vs Ibr How Do They Compare Student Loan Planner

Income Driven Repayment Calculator Fitbux Articles

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Whose Income Counts For Income Driven Repayment Plans

2

Income Based Repayment Calculator Includes Biden Ibr Plan

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero